accumulated earnings tax c corporation

The tax rate on accumulated earnings is 20 the maximum rate at which they would. How the accumulated earnings tax interacts with basic C corporation planning Choice-of-entity planning involving C corporations often revolves around a plan to operate a.

Is Corporate Income Double Taxed Tax Policy Center

C corporations can earn up to 250000 without incurring accumulated.

. May 17th 2021. In this article Cory Stigile provides background on the accumulated earnings tax and explains the steps corporate taxpayers may be able to take if the government begins to. Accumulated Earnings Tax will sometimes glitch and take you a long time to try different solutions.

The tax is in addition to the regular corporate income tax and is. LoginAsk is here to help you access Accumulated Earnings Tax quickly and handle. IRC 1368 c 1.

The tax is in addition to the regular corporate income tax and is. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. The rate for the accumulated earnings tax is the same as the rate individual taxpayers pay on dividends or.

Accumulated Earnings Tax There is an accumulated earnings tax designed to bar corporations from keeping earnings on reserve rather than distributing them to shareholders as dividends. The accumulated earnings tax is considered a penalty tax to those C corporations that have. However if a corporation allows earnings to accumulate.

The accumulated earnings tax is an annual tax levied on modified taxable income Sec. Accumulated Earnings Tax is a corporate-level tax assessed by the IRS. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons.

535b retained in the business in excess of its reasonable needs. The characterization of the. Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and.

The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue. If an S corporation has accumulated EP tax-free distributions generally can be made to the extent of the corporations AAA. The C corporation is considered for income tax purposes a separate entity from its shareholdersit is assessed an income tax on corporate earnings at the corporate tax rate.

This is because corporations that do not spend retained earnings. For C corporations the current accumulated retained earnings threshold that triggers this tax is 250000. Filed its 1995 tax return showing a liability of 2674 which it paid in March 1996.

Up to 10 cash back 20. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed. Its purpose is to prevent the accumulation of earnings if the reason for such is for shareholders to.

The accumulated earnings tax is computed on the corporations accumulated taxable income for the taxable year or years in question. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the. Metro Leasing and Development Corp.

The IRS audited Metros return and after modifying the companys. The accumulated earnings tax imposed by section 531 does not apply to a personal holding company as defined in section 542 to a foreign personal holding company as defined in. Breaking Down Accumulated Earnings Tax.

The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable income. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends.

How Directors Use Shareholder Dividends To Build Owner Value

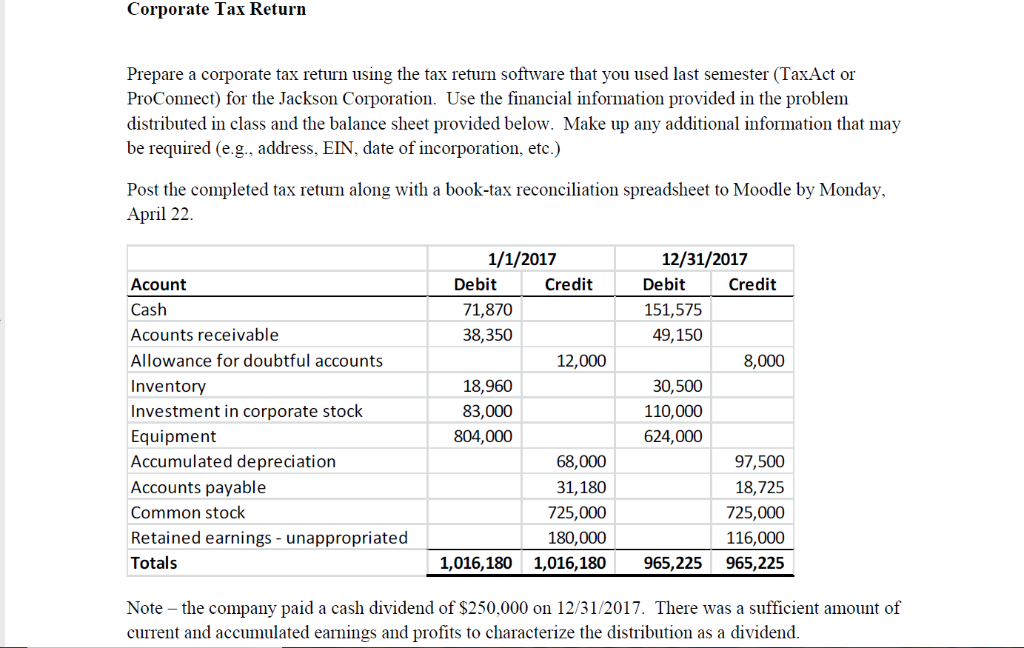

Corporate Tax Retur Prepare A Corporate Tax Return Chegg Com

What Are Accumulated Earnings Definition Meaning Example

Earnings And Profits Computation Case Study

Earnings And Profits Computation Case Study

Income Tax Computation For Corporate Taxpayers Prepared By

Oh How The Tables May Turn C To S Conversion Considerations Stout

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Demystifying Irc Section 965 Math The Cpa Journal

Determining The Taxability Of S Corporation Distributions Part Ii

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

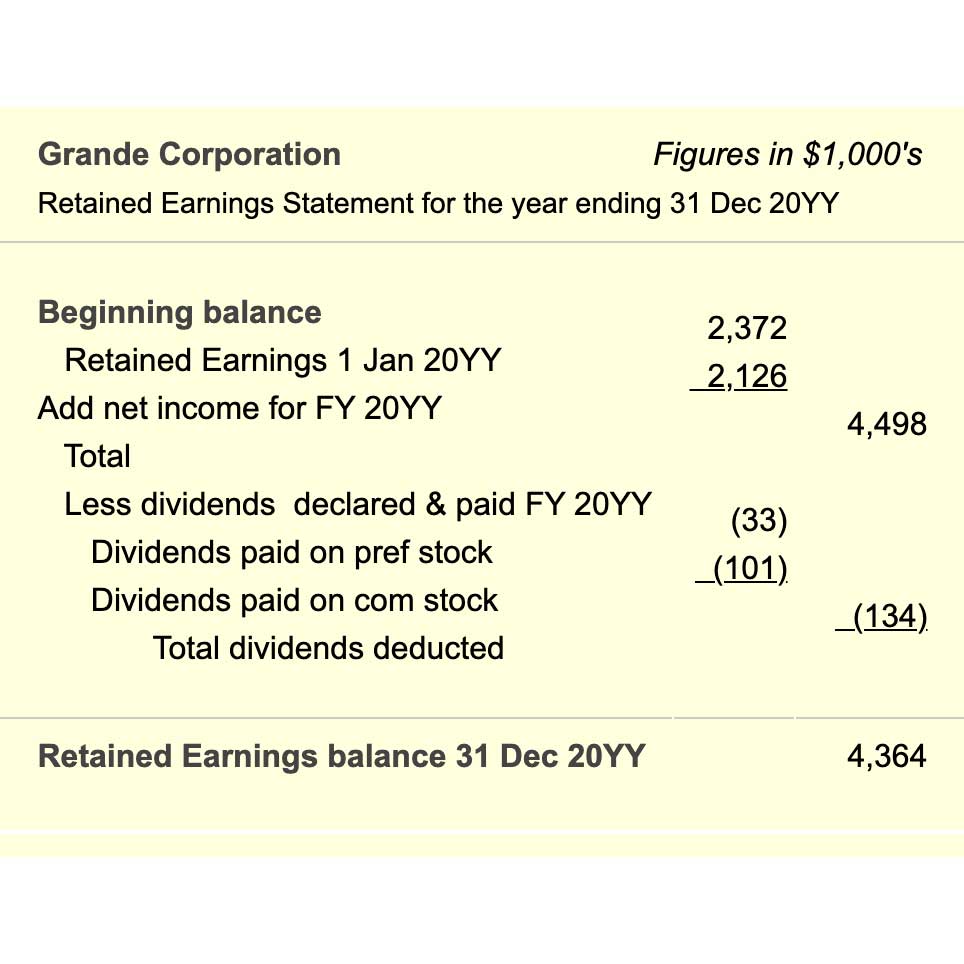

Retained Earnings Definition Example Simple Accounting

Earnings And Profits Computation Case Study

Darkside Of C Corporation Manay Cpa Tax And Accounting

Is Corporate Income Double Taxed Tax Policy Center

Determining The Taxability Of S Corporation Distributions Part I